Photography: Jannie Herbst

The “essential” off-road grudge purchase. This is how many 4×4 owners regard insurance for their vehicles. You don’t want it, but you have to have it.

But don’t get me wrong – I’m not saying that it’s about cross-border cover versus domestic cover. A river is a river, no matter where it is.

You want cover that will pay when you experience a situation in a river and need to replace your 4×4’s engine, be it the low-water crossing near your home, or the Chobe River in Botswana.

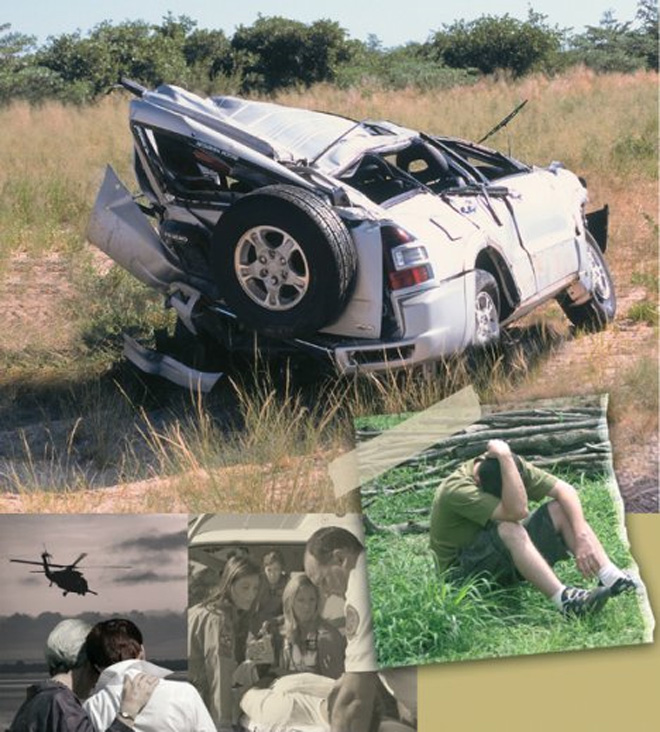

But perhaps before we go into the details we should look at some of the most common situations that occur in the bush, and at the same time what could have been done to avoid a failure and insurance claim.

Many minor accidents take place while reversing. “Oh no, I never saw the tree behind me and now the rear of my bakkie is wrecked!”

In most cases when this happens the driver is unable to see anything in his rear-view mirror because the canopy obscures the view or the loadbox is fully packed, and the driver has failed to check for any obstructions.

To make matters worse, there is often someone in the passenger seat instead of being behind the vehicle, giving directions.

When you plan to attempt a river crossing, check it. How often does it play out like this: “No man Kosie, we don’t have to walk it? this bakkie has been through maaaaany river crossings, no problem! It can wade through water 800mm deep!”

So in goes the bakkie, and the engine dies halfway through the crossing, in water that’s more than one metre deep.

The result is a very costly repair bill – and an insurance claim to boot.

Then there is grass. Not the common variety you will find in most gardens. The tougher stuff that makes up the African bush, and savannahs.

You drive for hours in low-range through this grass, never stopping as you want to get to camp and have the first frosty. Then, some time later, you notice a strange, orange glow underneath your 4×4. And it’s not the sunset.

Before you can say “holy smoke!” the glow spreads and the vehicle is engulfed in flames.

What the blazes happened, you wonder. Spontaneous combustion?

After a long day’s drive the vehicle’s exhaust system and catalytic converter are piping hot, and with dry grass lodged in the undercarriage and in the engine bay, the smouldering grass can ignite – and within about two minutes your vehicle will be no more.

Sadly, some of the more common accidents result from a loss of control of a vehicle, coupled to a lack of understanding of the vehicle’s dynamics.

Yes, the extra weight and height affect the centre of gravity, cornering and braking. Yes, on gravel a vehicle equipped with ABS braking does take longer to come to a stop than one without the system. Yes, you have to slow down while cornering. This is not a race, and no-one wants to overtake you in the corner.

If the vehicle does end up in an over-steer situation (where the back-end wants to overtake the front), and your name is not Sarel van der Merwe, you are likely to hit a tree, slide off the road or even roll. Rather slow down and enjoy the holiday.

Now a few questions pose themselves. What should you look for in your policy before signing on the dotted line? What is important if you and the family are going to head outdoors and across borders on a regular basis?

I spoke to Ian Georgeson, the managing director of an insurance company that specialises in 4×4 vehicle insurance, to get the low-down.

“It’s a specialised business and one has to offer high levels of service to stay in the game. It’s all very well simply branding a policy as a 4×4 policy, but when the claims come in you have to walk the talk,” says Georgeson.

“A good policy from a reputable company has to look after you and your family as well as your belongings and vehicle, if you get into trouble.”

Georgeson suggests that you look at the following pointers before signing on the dotted line, if you want peace of mind:

* International repatriation cover for your family, vehicle and any trailer or caravan, as well as contents. This extends to dirt bikes, quads and jet skis.

* Medical assistance and medical evacuation cover for all family members.

* Roadside assistance, even if it’s off-road.

* Technical and mechanical assistance in the event of a breakdown.

* Car hire, in case your own vehicle is not going anywhere soon.

* Passenger and third party liability.

* Vehicle replacement within the first 12 months of the policy term.

* Cover for all fitted vehicle and lifestyle related accessories such as mountain bikes, photographic equipment, and so on.

* The policy should cover private and business usage.

* Cover should extend to winching equipment as well as locks and keys and vehicle sound equipment.

* Territorial limits should cover most southern African countries south of the equator as well as Kenya.

There are other factors to keep in mind, too.

“Approved 4×4 training certificates enable a customer to negotiate a better rate,” says Georgeson. “An experienced driver will obviously know the pitfalls of overlanding better than a rookie. But even the experienced drivers do get it wrong, and that’s when an insurance policy is vital.”

More information:

* Outsurance, OUT-in-Africa 4×4: www.outsurance.co.za; 08 600 60 000

* Tuffstuff 4×4 Insurance: www.tuffstuff.co.za; 0861 44 44 00

* CrossCountry: www.ccic.co.za, Tel. 011 215-8800